Know who you’re doing business with

Verify signer identity beyond the standard practice of clicking an emailed link. DocuSign Identify makes identity proofing and authentication a seamless part of eSignature. So you protect your important agreements, and your customer experience.

Support compliance

Help meet requirements with Know Your Customer (KYC), Anti-Money Laundering (AML) and regional regulations. Verification status is recorded in every Certificate of Completion.

Embed into eSignature

Integrate signing, identity proofing, and authentication into one connected DocuSign eSignature experience.

Operate globally

Access the industry’s largest network of identity verification and trust service providers. Choose from DocuSign native solutions or API-supported integrations.

Why a connected signing and identity verification experience matters

#1

#1 reason customers abandon transactions: lack of visible security*

84%

84% of businesses say certainty about customer ID reduces risk**

$36B

$36B in global fines for noncompliance with KYC, AML, and sanctions, from 2008 to 2019***

Add identification to your agreement workflow

DocuSign Identify includes identity proofing, authentication solutions, and API integrations, helping you transact agreements world-wide with increased trust and compliance.

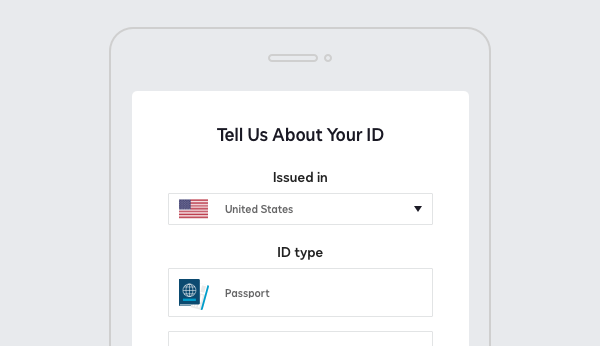

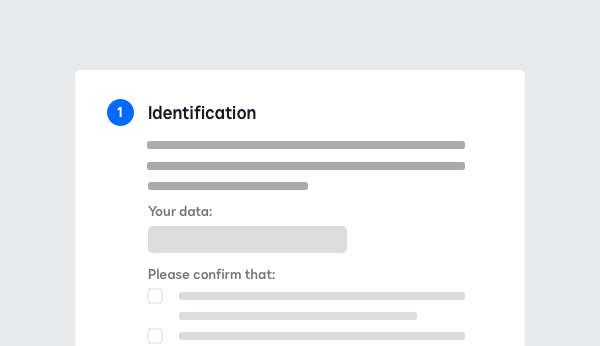

ID and eID Verification

Verify with major government-issued IDs and eIDs with ID Verification worldwide. Signers can also submit their existing bank logins to confirm identity.

Knowledge-Based Authentication

Part of ID Verification, KBA lets signers verify their identity by correctly answering personal questions about themselves.

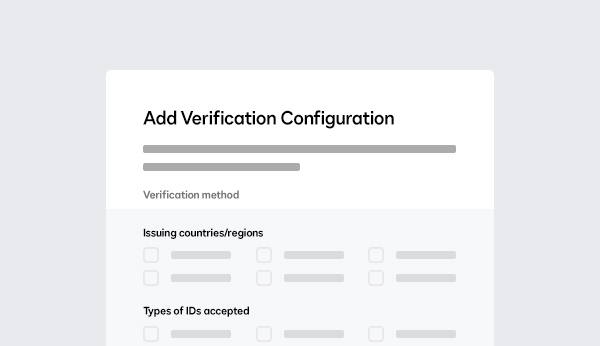

Flexible Admin Controls

Choose from pre-set configuration or customize, such as type of ID methods and country of issuance accepted, ID data retained, and name matching precision.

Identification for digital signatures

Combine with our Standards Based Signatures offerings to sign digital signatures, including Advanced and Qualified Electronic Signatures under eIDAS.

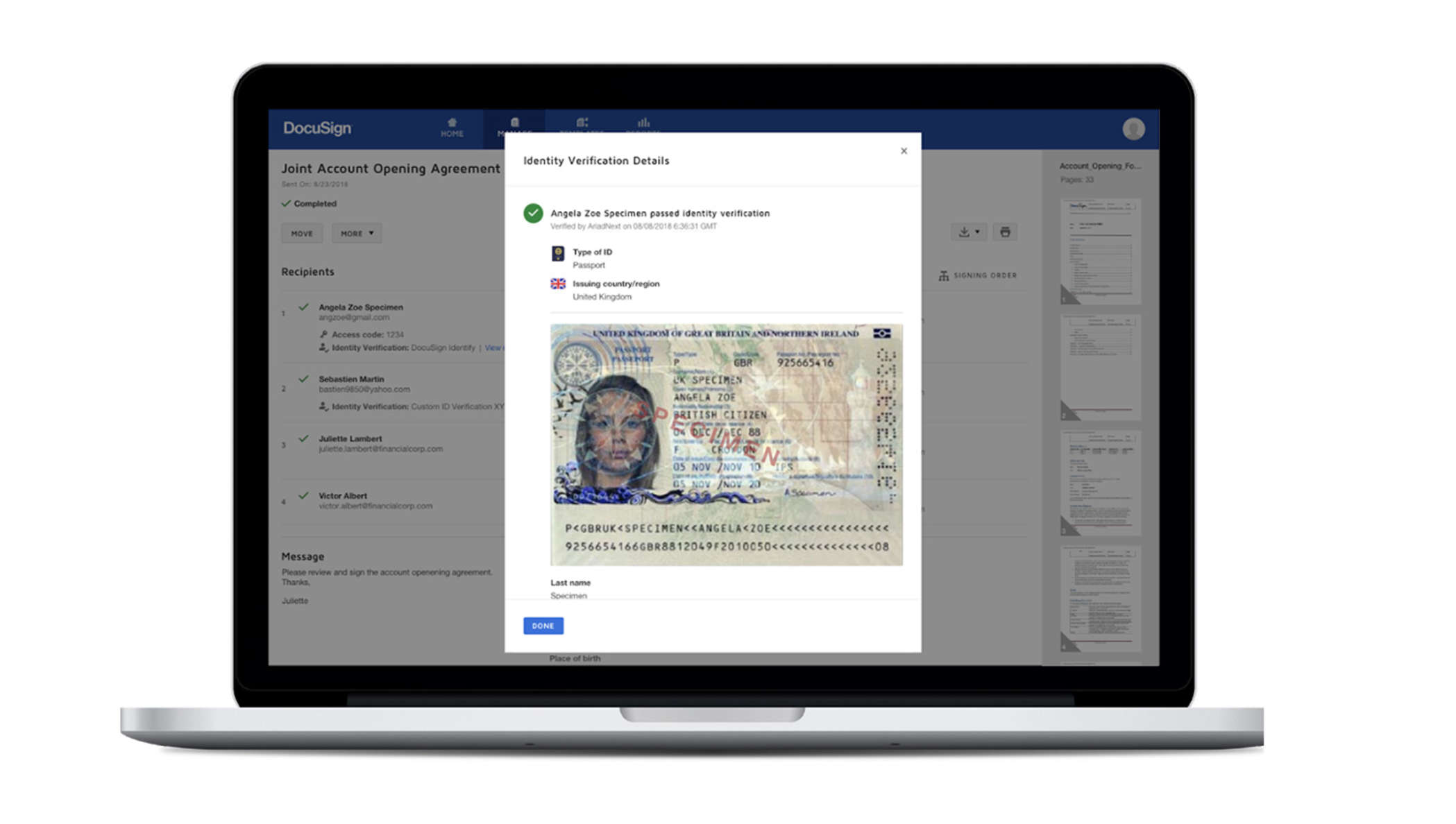

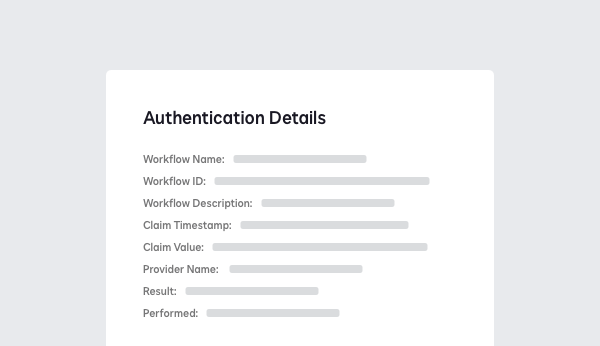

Proof of Verification

Write verification status and ID data into your system of record using APIs. Authentication details appear in every eSignature Certificate of Completion.

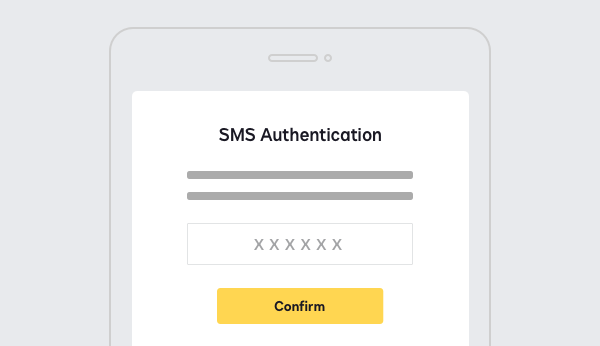

SMS Authentication

Easy two-factor authentication with a one-time code available to users in 180+ countries. Use it as a stand-alone solution or add to your identity verification process.

New features for ID Verification

New ID methods

Signers can use their existing bank credentials or answer personal questions to prove their identity. Available in US.

Global expanded IDs

ID Verification gives senders the option to accept more IDs. Signers select ‘Other” from a list of countries and senders can manually review and approve the ID documents.

ID Evidence

As an option, you can retain and extract ID information into your own systems of record, or download as a PDF, helping to support audit and compliance requirements.

Bringing Greater Speed, Security and Convenience to Banking

“ID Verification helps with compliance on KYC and makes M&T’s life easier."

Sandra Bell

VP, Enterprise Transformation Office

M&T Bank

Learn how M&T Bank added new digital capabilities to enhance security and customer experience, saving $17 per document in an account opening use case.

Read the customer story Sandra Bell

VP, Enterprise Transformation Office

M&T Bank

Learn how M&T Bank added new digital capabilities to enhance security and customer experience, saving $17 per document in an account opening use case.

Digital application process for faster, better customer experience

Leading lending platform in the UK created a digital application workflow with eSignature and ID Verification, and reduced average time to process by 98%.

Digitizing the account opening process

Kleberg Bank streamlined the account opening process with eSignature and ID Verification, increasing efficiency and improving customer experience.

Speeding customer access to capital

Pawnee Leasing customers are able to access capital 50% faster with DocuSign eSignature.

DocuSign Identify use cases

- Account opening and onboarding

- Lending, leasing and financing

- Insurance applications

- Good practice guidelines agreements

- Auto test drive and sales agreements

- Patient consent management

- Employee onboarding

Resources

Learn more about DocuSign Identify

Balancing security and customer experience in Identity Verification

Learn more about how leading organizations balance security and customer experience in identity verification

Accelerating Digital Transformation: Spotlight on Financial Services

Learn how financial services are accelerating their identity verification processes

DocuSign Identify datasheet

Learn more about DocuSign Identify solutions and benefits in this datasheet.