Implementing eSignature to Modernize Wealth Management

Wealth managers are in the business of providing quality financial advice to their clients, but complex paperwork—such as investment agreements, compliance documentation and custodian forms—often gets in the way of the client-advisor relationship. To solve these problems, teams are adopting eSignature.

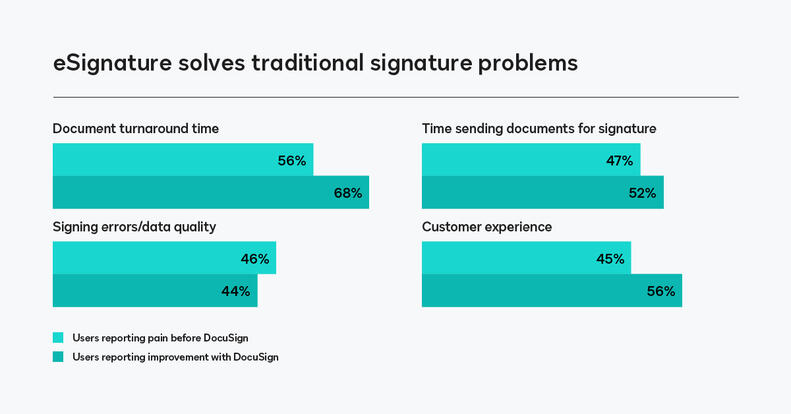

As the world leader in e-signature, DocuSign conducted a study of current customers to explore the way this technology can benefit wealth management firms. Respondents were asked a series of questions about their experiences before and after implementing eSignature. The results show that the most painful agreement problems are significantly improved.

Even more impressive than simply the number of DocuSign users who are eliminating traditional agreement pain points is the degree to which they have solved these problems. eSignature users have cut turnaround time by 40% and time spent sending documents for signature by 36%. When it comes to agreement data, 94% reported that the quality had improved either somewhat or significantly.

Using DocuSign technology, wealth managers have already reduced paper-based contracts by 51%, with a 40% reduction in hard costs.

The benefits of this technology goes beyond simply erasing common document inconveniences. In a lot of cases, eSignature translates directly to revenue. Four out of five wealth management firms using eSignature report a decrease in hard costs and two out of five report a decrease in labor costs.

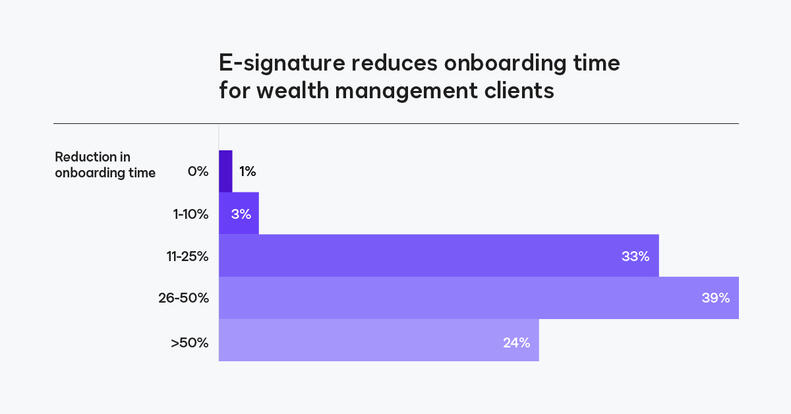

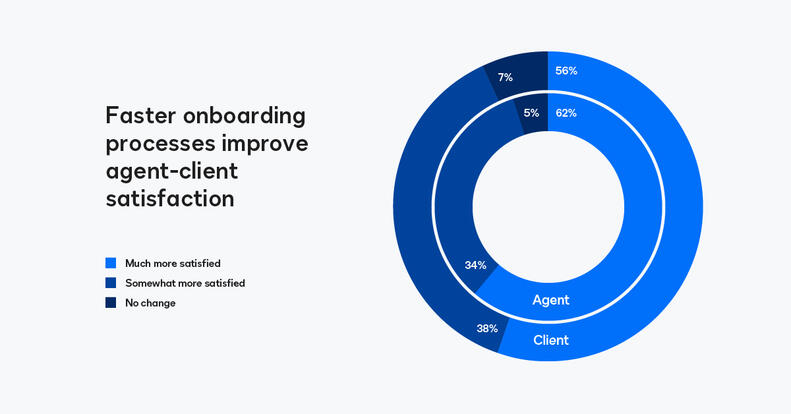

On average, wealth management firms using DocuSign reduce new customer onboarding time by 41%, which means more new business, happier customers and better use of employee time. It’s no surprise that employee satisfaction has also increased at these organizations.

DocuSign unlocks value for wealth managers beyond the collection of a digital signature. Bulk send allows advisors to streamline and send annual disclosures to their client base in a timely manner. When combined with detailed audit trails, compliance efforts can easily be streamlined. Advanced workflows allow advisors to efficiently route documents to different teams—product, legal, etc.—for review anytime collaboration is required.

By expanding the agreement process to be more connective—adding more features, more teams and more integrations—wealth management firms can increase the return on their investments in agreement technology and worry less about compliance issues.

*The data for this research was collected by Paradoxes (commissioned by DocuSign) in the summer of 2021. A survey of about 60 questions was completed by 440 respondents in the U.S. and Canada. Participants included a blend of senior roles (primarily in finance departments) from organizations that specialize in banking, lending, insurance and wealth management.