Accelerated closing times mean better service

DocuSign Rooms for Mortgage

Accelerate closing times and improve the borrower experience with a secure, digital workspace for everyone involved in a mortgage.

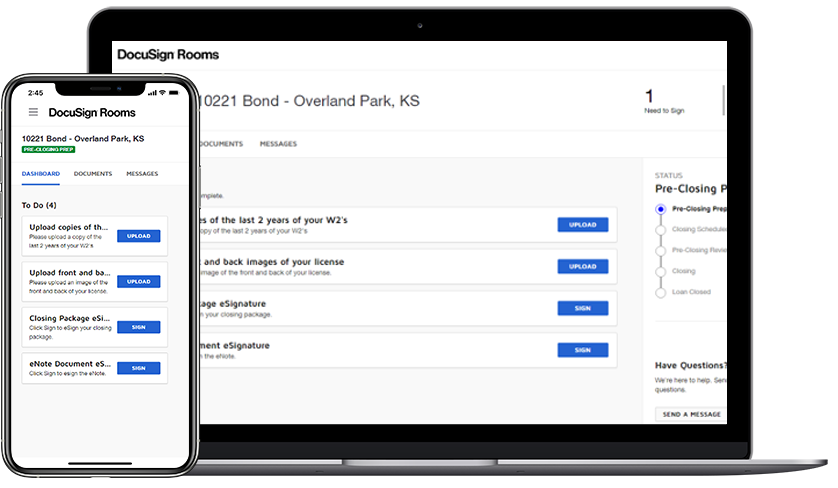

Instead of downloading forms and emailing, lenders can use Rooms for Mortgage to collect borrower documents, accelerate closing packages with external participants like title and settlement, and create configurable checklists and reminders for a smooth closing.

Delivering the modern mortgage experience

Read this whitepaper to learn how digital transformation is helping to connect disjointed processes and improve the customer experience.

Features and benefits

Build the modern mortgage

Easily configure workflows to support hybrid closing, multiple buyer and other complex scenarios. Borrower view improves the mortgage customer experience with easy lender set up.

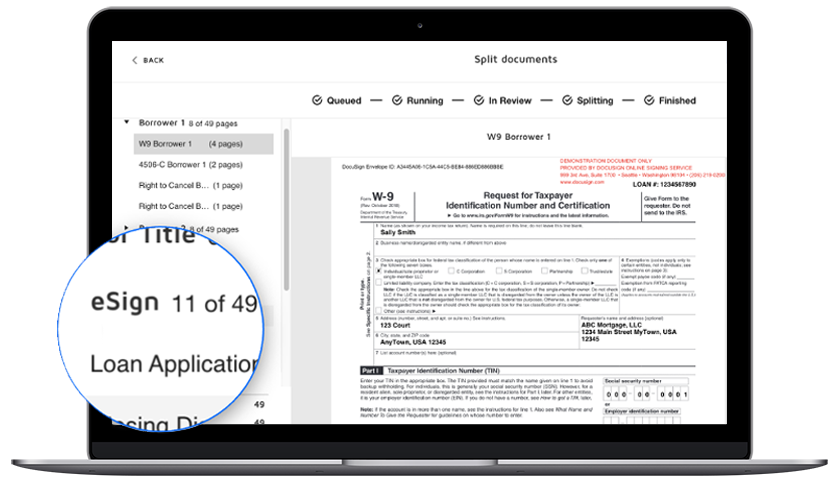

Prepare closing documents in minutes

Find, split and prepare closing documents with the Split Documents capability. Reduce closing preparation time and improve closing error rates.

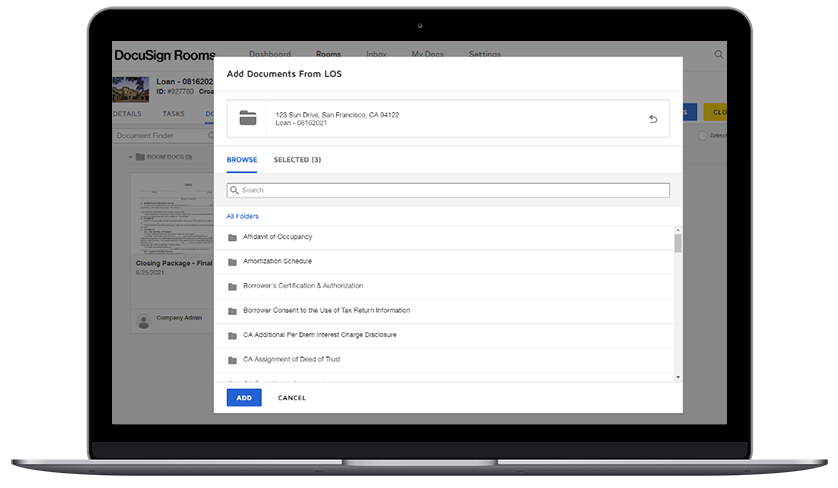

Provide a seamless digital experience

Easily import documents from your preferred loan origination software or embed them directly into customer banking portals using pre-built integrations and open APIs.

Solution features

Secure, digital workspace

Easy setup and maintenance

Built-in communication tools

Create better customer experiences

Improve collaboration and closings with a secure digital workspace for everyone involved in a mortgage.