b789.jpg)

Cut costs, time, errors, and paper

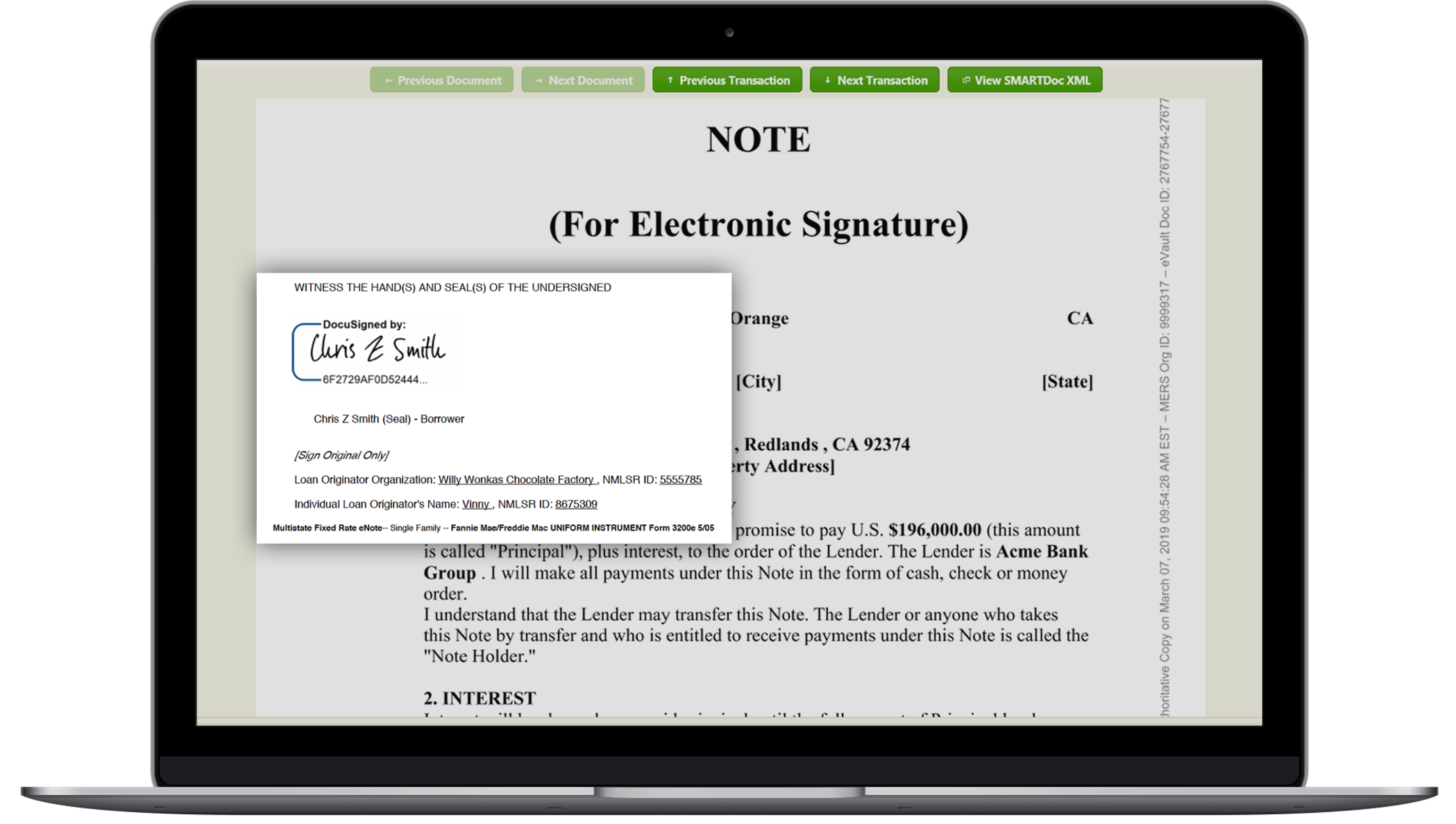

DocuSign eNote by eOriginal is an electronic version of a promissory note for mortgage transactions. Used in conjunction with DocuSign Asset Vaulting by eOriginal, DocuSign eNote maintains an authoritative electronic copy of the promissory note, including its ownership reflective of any transfers of control. Digitally signed eNotes allow lenders and borrowers to avoid the costs, delays, errors, and security risks of manual, paper processes.

100% electronic

Superior security versus paper

Transfer instantly

FAQ

Frequently asked questions

What does “powered by eOriginal” mean?

DocuSign eNote is a product that DocuSign sells and supports. We offer it in partnership with eOriginal, which developed and delivers the product. Through management of authoritative copies, eOriginal guarantees trusted transactions of digital financial assets for all parties.

Is DocuSign eNote approved by Fannie Mae and Freddie Mac?

Yes, DocuSign eNote is on both Fannie Mae’s and Freddie Mac’s lists of approved eNote solutions.

What is the difference between eNote and eNotary?

eNotary is a way to execute notarial acts electronically—including notarization for mortgage transactions that involve eNotes. However, eNotes themselves are only signed, not notarized; it’s other aspects of the mortgage that need notarization. eNotary laws vary by U.S. state, whereas the relevant laws and standards for eNotes apply nationwide.