Spotlight on Digital Transformation Trends in Financial Services and Insurance

It’s time to automate and connect the entire agreement process.

Financial services institutions (FSIs) have big goals this year. As a product of the COVID-19 pandemic and competitive forces, the industry underwent rapid digitization, with new account applications to small business loans all being virtually issued.

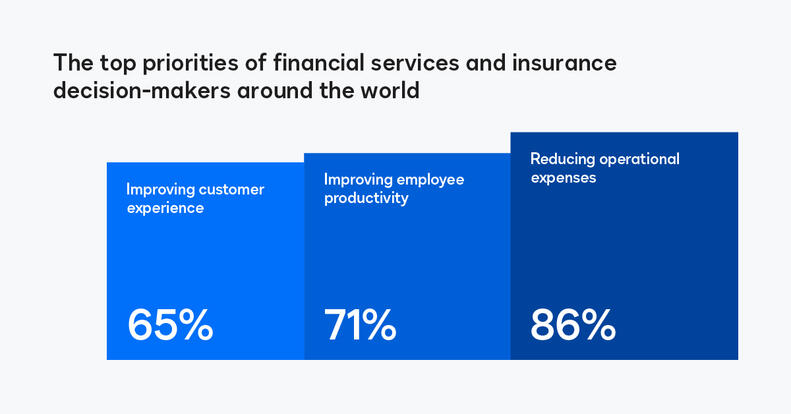

As the digital journey continues, a Forrester study commissioned by DocuSign took the pulse of the priorities of financial services and insurance decision-makers around the world:

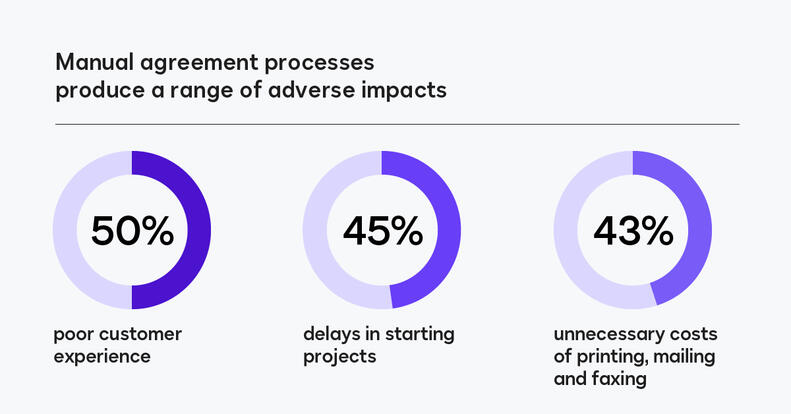

But there are common obstacles preventing teams from achieving these goals. Manual agreement processes produce a range of adverse impacts:

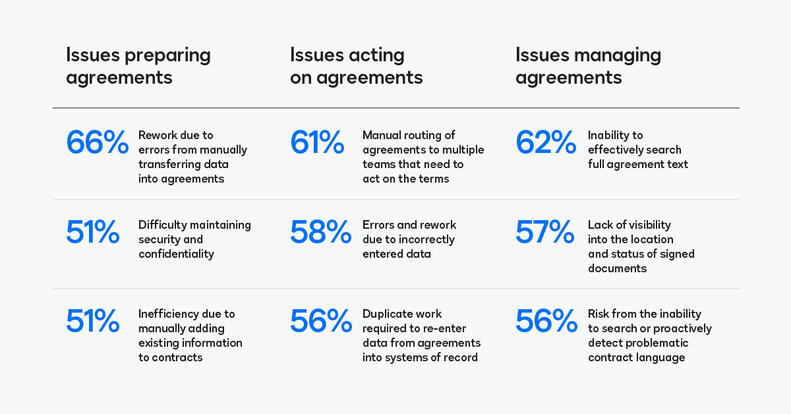

From account opening to loan applications, asset transfers to client onboarding, FSIs run on agreements. In Forrester’s survey, 90% of respondents said their team processes more than 500 agreements per month. Many financial institutions have adopted eSignature as the first step to improve agreements. More than three in five respondents electronically sign agreements and more than four in five are using technology to digitally route documents.

Despite these advances, financial institutions still encounter issues before and after the signature. Throughout the lifecycle of a contract, there is too much duplicate work, which often opens the door for errors or increases risk.

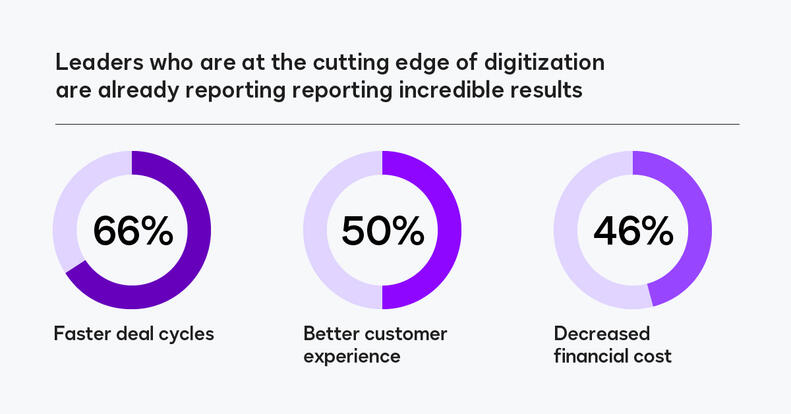

It’s no wonder that 63% of respondents are making a modernized contract and agreement processes a high priority this year. The leaders who are at the cutting edge of digitization are already reporting incredible results:

With the Docusign Agreement Cloud, financial institutions can create a faster, more secure and easier agreement process. Innovative financial services and insurance leaders are already reporting that a modern system of agreement reduces cost and risk while producing a better experience for customers, employees and partners.

To learn more, download The State of Systems of Agreement, 2021: A Spotlight on Financial Services & Insurance.